SAHARA

Set up on April 3, 2004, Sahara Insurance has managed to benefit from this economic opening to get well positioned on the market. Managed by Ibrahim Felfel, an emblematic figure of Libyan insurance, Sahara Insurance is on a regular progression in 2007, a net profit accounting for 10% of its turnover, a return on equity of 23.3% and a shareholders' equity‘s in progression by 47%.

In two years' time, the volume of written premiums has more than doubled. It has risen from 10 292 000 LYD (7 394 184 USD) in 2005 to 21 051 000 LYD (17 570 888 USD) in 2007. For Sahara's management, maintaining a high growth rate cannot be achieved unless a development of human resources and an extension of the insurance distribution network to the whole territory are made possible.

|  |

| Ibrahim Mohamed Felfel | Mohamed Reda M. Mejrab |

| Chief Executive | Deputy Chief Executive |

Sahara in 2007

| Capital | 12 519 750 USD |

| Turnover | 17 570 888 USD |

| Shareholders' equity | 15 141 558 USD |

| ROE | 23.30% |

| Net profit | 1 851 347 USD |

| Loss ratio | 59.54% |

| Number of employees | 65 |

| Number of agencies | 3 |

Management

| Chief Executive | Ibrahim Mohamed Felfel |

| Deputy Chief Executive | Mohamed Reda M. Mejrab |

| Vice President, Marine insurance | Abdussalam S. Aburuween |

| Vice President, Finance & Administration | Abdul Latif Eshabba |

| Vice President, IT | Alamouri Abouajala Abokhdir |

| Vice President, Life & Health insurance | Milad Omar Mezoughi |

Main shareholders

| National Investment Company | 45% |

| Al Jumhoriya Bank | 10% |

| Exchange and Financial Services Company | 5% |

| Private sector's companies and individuals | 40% |

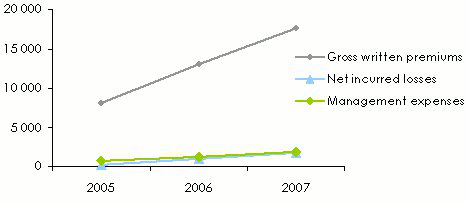

Main technical and financial highlights: 2005-2007

in USD

| 2005 | 2006 | 2007 | |

|---|---|---|---|

Gross written premiums | 8 046 764 | 13 056 576 | 17 570 887 |

Net earned premiums | 653 340 | 2 325 194 | 3 035 463 |

Net incurred losses | 192 947 | 1 025 863 | 1 807 272 |

Management expenses 1 | 788 342 | 1 302 251 | 1 883 139 |

Technical results | 2 004 259 | 2 806 843 | 2 280 954 |

Net profit | 1 220 960 | 1 640 971 | 1 851 347 |

Loss ratio | 29.53% | 44.12% | 59.54% |

Capital | 3 767 742 | 8 178 600 | 12 519 750 |

Shareholders' equity | 4 988 703 | 10 122 172 | 15 141 558 |

Return on equity | 36.80% | 25.90% | 23.30% |

Technical reserves | 2 503 553 | 3 703 463 | 3 163 557 |

Total assets | 9 199 082 | 18 261 218 | 31 488 773 |

1 Intermediaries' commissions + administration fees

Evolution of the written premiums, losses and expenses: 2005-2007

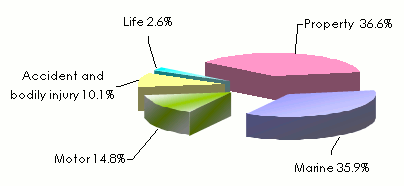

Breakdown of the gross written premiums: 2005 - 2007

in USD

| 2005 | 2006 | 2007 | ||||

|---|---|---|---|---|---|---|

| Amount | % | Amount | % | Amount | % | |

| Non life | ||||||

Marine and aviation | 4 865 515 | 60.5 | 7 254 819 | 55.5 | 6 302 087 | 35.9 |

Property | 2 543 571 | 31.6 | 3 882 182 | 29.7 | 6 438 278 | 36.6 |

Motor | 596 382 | 7.4 | 1 300 388 | 10 | 2 592 051 | 14.8 |

Accident and bodily injury | 41 296 | 0.5 | 384 368 | 3 | 1 783 465 | 10.1 |

| Life | ||||||

Total life | - | - | 234 819 | 1.8 | 455 006 | 2.6 |

Total | 8 046 764 | 100 | 13 056 576 | 100 | 17 570 887 | 100 |

Breakdown of the written premiums in 2007

Evolution of the loss ratio: 2005 - 2007

in %

| 2005 | 2006 | 2007 | |

|---|---|---|---|

Marine and aviation | 20.09 | 26.29 | 32.40 |

Property | 5.01 | 11.84 | 7.15 |

Motor | 67.06 | 73.62 | 93.35 |

Accident and bodily injury | - | 5.32 | 47.36 |

Total | 29.53 | 44.12 | 59.54 |

Exchange rate LYD/USD as at 31/12 | 2005 | 2006 | 2007 |

0.71844 | 0.75256 | 0.80717 |

Contact

| Head office | Ahmed Swaihli Street, Abu Miliana DC BP 2422 Tripoli - Libya |

| Phone | (+218) 21 334 1562/63 – 444 2765 - 333 9810 – 334 3171 |

| Fax | (+218) 21 444 9161 – 444 4160 |

| Website |