The Malaysian insurance market

Insurance market features

- Regulatory authority: Bank Negara Malaysia Insurance Regulation Department

- Premiums (2005): 6.23 billion USD

- Insurance density (2005): 233 USD

- Penetration rate (2005) : 4.8%

Market structure in 2005

Actors | Number |

|---|---|

Insurance companies | 42 |

- life | 7 |

- non life | 26 |

- composite | 9 |

Reinsurance companies | 7 |

Identity

- Area: 329 750 Km2

- Population (2005): 26 700 000 inhabitants

- GDP (2005): 130 billion USD

- GDP per capita (2005):

4 869 USD - GDP growth rate (2005): 5.3 %

- Inflation rate (2005): 2.9 %

- Main economic sectors: rubber, palm oil, light manufacturing industry, tin mining and smelting, petroleum production, cocoa, rice, timber

Main cities

(in number of inhabitants)

- Kuala Lumpur (capital):

4 000 000 - Johor Bahru: 1 100 000

- Labuan: 75 000

Turnover evolution: 2002-2005

in millions USD| Premiums | 2002 | 2003 | 2004 | 2005 | 2004/2005 growth rate |

|---|---|---|---|---|---|

Non life | 1 585.7 | 1 698.7 | 1 822.5 | 1 997.4 | +7.19% |

Life | 2 852.1 | 3 265.0 | 3 990.2 | 4 233.3 | |

Total | 4 437.7 | 4 963.7 | 5 812.7 | 6 230.7 |

Premiums split by class of business: 2004-2005

in millions USD| 2004 | % | 2005 | % | |

|---|---|---|---|---|

| Non life | ||||

Motor | 1 037.8 | 17.9% | 1 173.6 | 18.8% |

Fire | 302.2 | 5.2% | 321.0 | 5.1% |

Accident & health | 215.7 | 3.7% | 229.6 | 3.7% |

Marine | 85.3 | 1.5% | 91.0 | 1.5% |

Miscellaneous | 88.2 | 1.5% | 90.4 | 1.5% |

Engineering | 57.5 | 1.0% | 54.0 | 0.9% |

GTPL | 35.8 | 0.6% | 37.8 | 0.6% |

Non life total | 1 822.5 | 31.4% | 1 997.4 | 32.1% |

| Life | ||||

Life total | 3 990.2 | 68.6% | 4 233.3 | 67.9% |

Grand total | 5 812.7 | 100.0% | 6 230.7 | 100.0% |

Premiums split by class of business in 2005

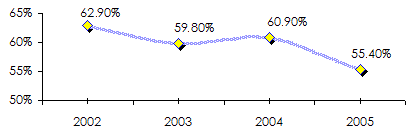

Non–life loss ratio: 2002-2005

Exchange rate USD/MYR as at 31/12 | 2002 | 2003 | 2004 | 2005 |

3.798 | 3.79 | 3.792 | 3.782 |

Source: Bank Negara Malaysia (2005)

0

Your rating: None

Wed, 15/05/2013 - 11:50

The online magazine

Live coverage

05/03

05/03

05/03

05/03

05/02

Latest news