Insurance fraud detection and cost to industry

Nearly 54% of insurers believe that fraud stands as the threat number one. It affects all insurance companies and all classes of business, compelling customers to bear its consequences in terms of the costs incurred while insurers have to endure the damage sustained by their image and reputation. Fraud is usually associated with insurance all along the life span of the contract, from the stage of underwriting the insurance policy until the notification of the claim. Consequently, the effort invested to counter this scourge has become essential for insurers as well as for customers.

History of the insurance fraud

|

Insurance fraud is so ancient and some preventative measures date back to Middle Ages. Back then, non-compliance with ethical rules could trigger extremely stiff sanctions. Prevention measures were then gradually introduced. In 1380, a Genoa decree imposed compulsory excess so as to protect goods whereas the 1435 Barcelona ordinance prohibited the insurance of the same product several times.

Insurance scammers have been severely punished when the salvaging of a merchant ship in the gulf of Gascoigne in the XV th century and the processing of its cargo revealed that the latter was full of stones whereas the bill of lading reported draperies. The ruling handed down in 1570 found both the ship captain and the insurance broker guilty and sentenced them to death.

In 1598, the Amsterdam rules issued from the Bruges and Anvers statutes provided for corporal and capital punishments for captains, pilots and policyholders in the event of scam.

In the 16th century, simple insurance legal measures were adopted, validating the insurance act only if there is insurable interest and that the policyholder had no knowledge of any loss at the time of the coverage purchase. It was equally requested that the insurance undertaker shall exhibit utmost care for the preservation of the insured item in the event of imminent hazard.

Nowadays, all classes of insurance business are strained by scam even though they are differently affected by this phenomenon.

Insurance fraud: definition and meaning

There is no legal definition for insurance fraud. According to the agency countering insurance fraud (ALFA), a 1901 legal association set up in France in 1989, insurance scam is a voluntary act perpetrated by the policyholder, enabling the latter to reap an illegitimate profit from an insurance contract.

This act entails bad faith on part of the policyholder. There can be no fraud established on the basis of mistake or when the policyholder has acted under the legitimate belief of not committing any irregularities.

Insurance fraudulent acts

|

Insurance fraud can be defined as a deliberate act committed against an insurer or an insurance broker with a view to obtaining a financial benefit. This gain may take the shape of undue service claimed in accordance with the terms of an insurance contract in force or a gain that comes by means of a service that can be due only in return for the payment of an additional premium. Committing scam is so simple that the fraudster gets the impression of acting without risk. Fraud may be internal or external, occurring at any stage of the duration of the contract:

- Upon declaration of the risk by the policyholder or his/her representative as long as the misrepresentation is intentional,

- Upon the sale of the contract by the representative of the insurer (insurance employee or agent). In this case, it is characterized as internal fraud,

- Upon declaration of the claim.

Internal scam is a problem suffered by all insurers, resulting from premeditated acts, committed by employees' complicity with policyholders.

Insurance fraud legislation

In insurance law, fraud can take various legal characterizations. It may be:

- reluctance or intentional misrepresentation by the policyholder during the underwriting of risk: Forging the real value of an insured item, insurance of inexistent item, submitting erroneous information, insuring an item after occurrence of the claim, etc.

- simulation of disability, common fraudulent practice in health insurance: Emotional trauma, etc.

- fraudulent over-insurance: overstatement of the insured value,

- multiple cumulative insurance policies: same covers being underwritten with several insurers,

- deliberate misrepresentation on the nature, causes, circumstances and consequences of a loss. Fraud after the occurrence of loss is commonplace. It may consist of incorrect description of the loss and of the circumstances surrounding the event. It may also pertain to an increase in the damage or the declaration of the same claim with several insurers, etc.

- forging, counterfeiting, corruption,

- deliberate destruction or deterioration of property.

External fraud nowadays comes in multiple fashions and may potentially target all kinds of insurance products. Acts of scam have witnessed development in terms of frequency as well as in terms of operating mode. This movement is accounted for by the following :

- rising cyber criminality,

- rising fraud due to duplication of false documents,

- growing professionalization and internationalization of malicious acts,

- the growth of fraud into organized gangs which are multiplying and getting internationalized through:

- repeated false claims or/and abroad in pension insurance,

- identity theft in life insurance,

- occurrence of serial claims or robberies disguised in motor insurance: sectors specialized in car robbery destined for export.

Health insurance accounts for a major part of fraudulent acts. Over-invoicing, false invoices, identity theft, cheating at the level of physical disabilities etc. are common practices.

Insurance fraud cost

Fraudulent act draw the attention of insurers on two issues:

- the estimation of fraud,

- the impact of fraudulent acts on the amount of the premiums.

Studies have been regularly carried out in an attempt to appraise the losses caused by fraud to insurers. For the European federation of insurance companies, “Insurance Europe”, fraud cost in Europe has been estimated at 10% of the total amount of claims. This percentage is remarkably higher in countries where insurance oversight is poorer, as is the case in Africa and in some Asian and South American countries.

The table hereafter features the estimates established by “Insurance Europe”:

| Country | Classes of business | Amount |

|---|---|---|

| Germany | All classes of business | 10% of losses' cost |

| Australia | All classes of business | 10% of losses' cost |

| Canada | All classes of business | 10% to 15% of losses' cost |

| Spain | Motor | 22% of losses' cost |

| Great Britain | Personal lines | 7% of losses' cost |

| Scandinavia | All classes of business | 5% to 10% of losses' cost |

| United States | Motor | 11% to 15% of losses' cost |

| United States | All classes of business | 10% of losses' cost |

Other examples:

In Great Britain, the association of British insurers established that the amount of fraud is estimated at 2.5 billion USD per year. In Germany, half the theft or damage reports pertaining to smartphones would be false.

The above-mentioned costs relate only to post-claim fraud. Under-estimation of premiums following misrepresentations upon underwriting of risks are not included in the amounts mentioned: under-evaluation of assets, applying advantageous premium rates, etc.

Insurance fraud prevention

|

In an eroded economic environment, it is essential for insurance companies to bring to an end or even root out fraud drastically. The cost incurred due to those acts is quite substantial. It triggers an increase in insurance premiums which is inconsistent with consumer expectation.

As far as insurers are concerned, fraud reignites the issue of the insurability of certain risks. In several developing countries, health insurance scams have rendered this class of business hardly appealing to insurers.

Fraud generalization has also caused loss of image for insurers. Countering fraud also allows to preserve honest policyholders, reduce the average amount of claims and to consolidate profitability.

Fighting insurance fraud

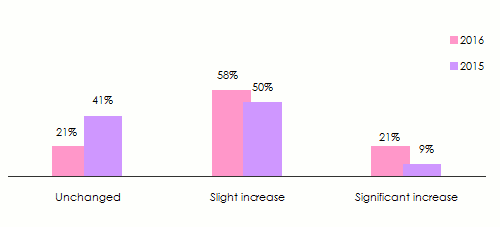

In view of the scale of fraud, the overwhelming majority of insurance companies are planning to dedicate more resources to the fight against this scourge. From 2015 to 2016, the prevention budget was on a rising trend for 79% of the insurers with 21% of notable increase and 58% of slight increase.

Many of them have set up mechanisms to counter this scourge internally as well as in terms of collaboration with the authorities or with private entities. Insurance companies, therefore, distinguish between two kinds of fraud:

- individual or occasional fraud

- fraud within organized gangs

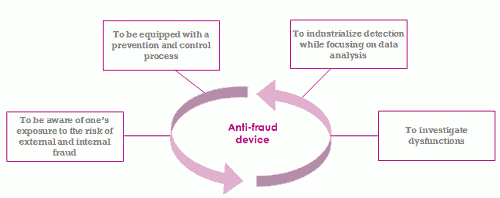

Fighting insurance fraud rests on four pillars: :

Source : Deloitte

Source : DeloitteWith the advent of new technologies and big data, some insurers have set up automated systems that detect suspicious behaviours. The so-called predictive analyses rest on specific data bases. Insurers, including Gen Re, endowed with its Risk Shield software, are developing automatic analysis tools for all declarations of claims.

An effective fight against fraud therefore requires a batch of measures such as:

- a good quality internal collection of information,

- the development of prevention and detection measures thanks to the establishment of computer facilities (IT systems),

- increasing internal control operations,

- centralization and information sharing with other insurers and also with the authorities as regards serious cases,

- the setting up of a database of incidents for established scams,

- awareness-raising and training of insurance employees,

- the contribution of professionals and experts.

Solvency II has, on its part, compelled insurers to take a certain number of measures such as: identification, evaluation and management of operating risks that have a potential effect on capital. Fraud risk has been regarded as part and parcel of the management of operational risks.

For a substantial risk, anti-fraud effort starts upon application for insurance. A consultation of in-depth risk stands as the first step of the prevention policy. In life insurance, medical check-up allows verification of the veracity of the statements submitted by the medical questionnaire.

Fraud perception by insurers

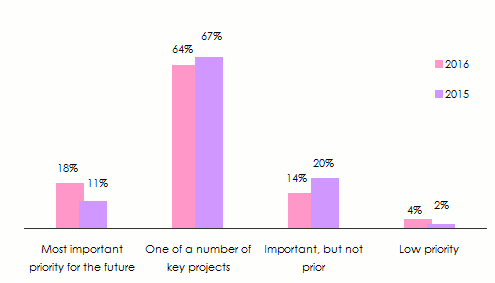

In a single year, the importance of fraud as perceived by leaders earned 7 points, rising from 11% in 2015 to 18% in 2016.

Insurance fraud : issues and challenges

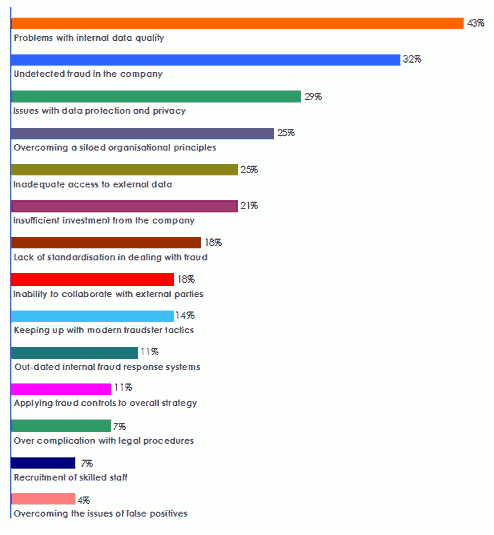

In order to counter fraud effectively and as a top priority, insurers are required to resolve a high number of hardships encountered both internally and externally. A great deal of these challenges is centered around the lack of data and inadequate response mechanisms for insurers to address fraud threats.

A survey, carried out with 200 insurance professionals in Europe has classified, in decreasing order, the challenges encountered by insurance companies in their fight against fraud.

Source: Insurance fraud survey 2016, Insurancenexus

Source: Insurance fraud survey 2016, Insurancenexus Insurance fraud-prone domains

|

Insurance professionals have established direct connection between economic and financial fragility of countries and fraud. Poor oversight both internally and on the level of supervisory authorities increase fraud risks, especially when it comes to commercial and industrial risks.

As far as these professionals are concerned, anti-fraud effort must necessarily target the following activities:

- underwriting and claims,

- the forms for risk declaration and claim notification,

- the sale of insurance products,

- digital transformation,

- consumer services,

- marketing

- corporate risks,

- pricing.

Insurance fraud repression

In order to combat fraud, it is necessary not only to detect it but also to provide evidence. This requirement entails the establishment of two elements that are hard to verify:

- Material evidence of fraud: misrepresentation or concealment on part of the policyholder,

- Evidence of the fraudulent intent on the part of the policyholder. The insurer has to establish the bad faith of the policyholder and his intention to cheat.

The burden of proof lies on the shoulder of the insurer who claims and makes these allegations. The policyholder, whose good faith is presumed, remains on the defensive side.