ARO

Renamed in 1976 Assurances Réassurances Omnibranches (ARO in Malagasy means protection), the company has developed its operations on the market thus becoming the undisputed leader with 60% of the total written premiums in 2005.

Renamed in 1976 Assurances Réassurances Omnibranches (ARO in Malagasy means protection), the company has developed its operations on the market thus becoming the undisputed leader with 60% of the total written premiums in 2005.

ARO's efforts to set up a robust financial company have crowned with success in 2006 with the rating “AA” awarded to it by the South African agency Global Credit Rating.

Thanks to its dominant position in Madagascar and to its solid bases, ARO may, henceforth, calmly face the opening of the Malagasy market to foreign capitals and promote its international development through reinsurance acceptance on the African market.

|  |

| Mr Guy Rasoanaivo | Mr Jimmy Ramiandrison |

| Chairman of the Board of Directors | General Manager |

ARO in 2005

| Capital | 7.013 billion MGA (3.248 million USD) |

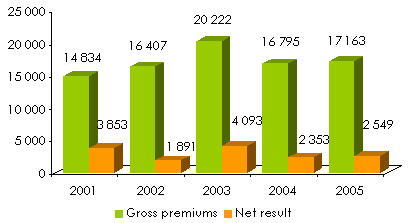

| Turnover | 37.056 billion MGA (17.163 million USD) |

| Net result | 5.5 billion MGA (2.547 millions USD) |

| Shareholder's equity | 42.684 billion MGA (19.770 million USD) |

| Number of employees | 444 |

Management

Chairman of the Board of Directors | Mr Guy Rasoanaivo |

General Manager | Mr Jimmy Ramiandrison |

Deputy General Manager | Mr Zoé Razanamahery |

Non Life Department | Mr Rakouth Zafiarisoa |

Finance & Administrative Department | Mr Andry Rabaonarison |

Legal Department | Mrs Sylvie Ranoroarivelo |

Marketing Department | Mr Mamy Ramiandrasoa |

Network Department | Mr Germain Rakotoarison |

Main shareholders

| Malagasy state | 73.35% |

| ARO's employees | 6.29% |

| SONAPAR (Société Nationale de Participations) | 6.59% |

| Société de gestion et de recouvrement | 2.93% |

| Others | 10.84% |

Turnover'split by class of business: 2003-2005

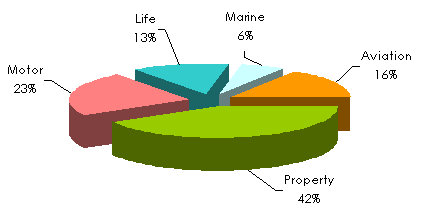

in thousands USD| 2003 | 2004 | 2005 | 2004/2005 growth | |

|---|---|---|---|---|

| Non life | ||||

Motor | 4 854 | 3 937 | 3 862 | -1.90% |

Fire | 1 067 | 772 | 812 | 5.18% |

Other liability | 2 617 | 2 160 | 2 544 | 18.02% |

Other property risks* | 4 912 | 3 225 | 3 565 | 10.54% |

Aviation | 3 156 | 3 083 | 2 593 | -15.89% |

Marine | 1 218 | 1 309 | 963 | -26.43% |

Total non life | 17 824 | 14 486 | 14 339 | -1.01% |

| Life | ||||

Total life | 2 131 | 2 020 | 2 166 | 7.22% |

| Acceptances | ||||

Total acceptances | 264 | 285 | 657 | 130.5% |

Total | 20 219 | 16 791 | 17 162 | 2.2% |

Turnover'split by class of business in 2005

Results 2001-2005

in thousands USD

Loss ratio by class of business: 2004-2005

in thousands USD| Earned premiums | Incurred losses | Ratios S/P (%) | ||||

|---|---|---|---|---|---|---|

| 2004 | 2005 | 2004 | 2005 | 2004 | 2005 | |

Motor | 3 531.3 | 3 690.1 | 910.9 | 741.4 | 25.79 | 20.09 |

Fire | 778.1 | 807.5 | - 220.4 | 986.8 | - 28.32 | 123.12 |

Other liabilities | 2 055.5 | 2 307.5 | 1 504.8 | 1 406.2 | 73.20 | 60.94 |

Other property risks* | 3 220.7 | 3 256 | 791.8 | 577.8 | 24.58 | 17.74 |

Aviation | 2 688.3 | 2 639.7 | 1 180.8 | - 92.2 | 43.92 | - 7.80 |

Marine | 1 188.7 | 1 061.3 | 1 839.5 | 790.2 | 154.74 | 74.45 |

Life | 428 | 509.4 | 242.5 | 303.9 | 56.65 | 59.65 |

Total | 13 890.6 | 14 271.5 | 6 249.9 | 4 714.1 | 44.99 | 33.03 |

Exchange rate MGA/USD as at 31/12 | 2003 | 2004 | 2005 |

0.000820 | 0.000535 | 0.000463 |

Contact

| Head office | BP 42 - Antananarivo 101 – Madagascar |

| Phone | (+261) 20 22 201 54 |

| Fax | (+261) 20 22 344 64 |

aro1 [at] wanadoo [dot] mg | |

| Website |

0

Your rating: None

Wed, 15/05/2013 - 15:20

The online magazine

Live coverage

10:00

04/17

04/17

04/17

04/17

Latest news